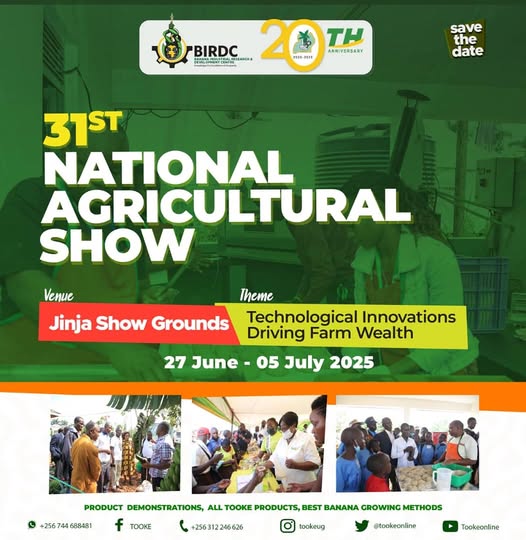

Postbank Uganda took center stage at the 31st National Agricultural Show in Jinja, demonstrating its commitment to empowering farmers through innovative, farmer-centric financial solutions.

Themed “Technological Innovations Driving Agricultural Wealth,” the week-long exhibition drew a diverse array of participants from across Uganda as well as the broader East and Southern African region, including a 10-member women’s delegation from Kenya and three representatives from Zambia.

As part of its active engagement, Postbank facilitated an interactive knowledge-sharing session with farmers, agri-entrepreneurs, and international delegates, highlighting inclusive and customized financing options designed to boost agricultural productivity and enhance financial inclusion within rural communities.

The bank showcased its specialized agricultural products, including the Large-Scale Commercial Farmers Scheme (LSCFS) and Grow Loans, which are designed to support different segments of the agricultural value chain—from smallholder farmers to agri-SMEs and rural women’s groups.

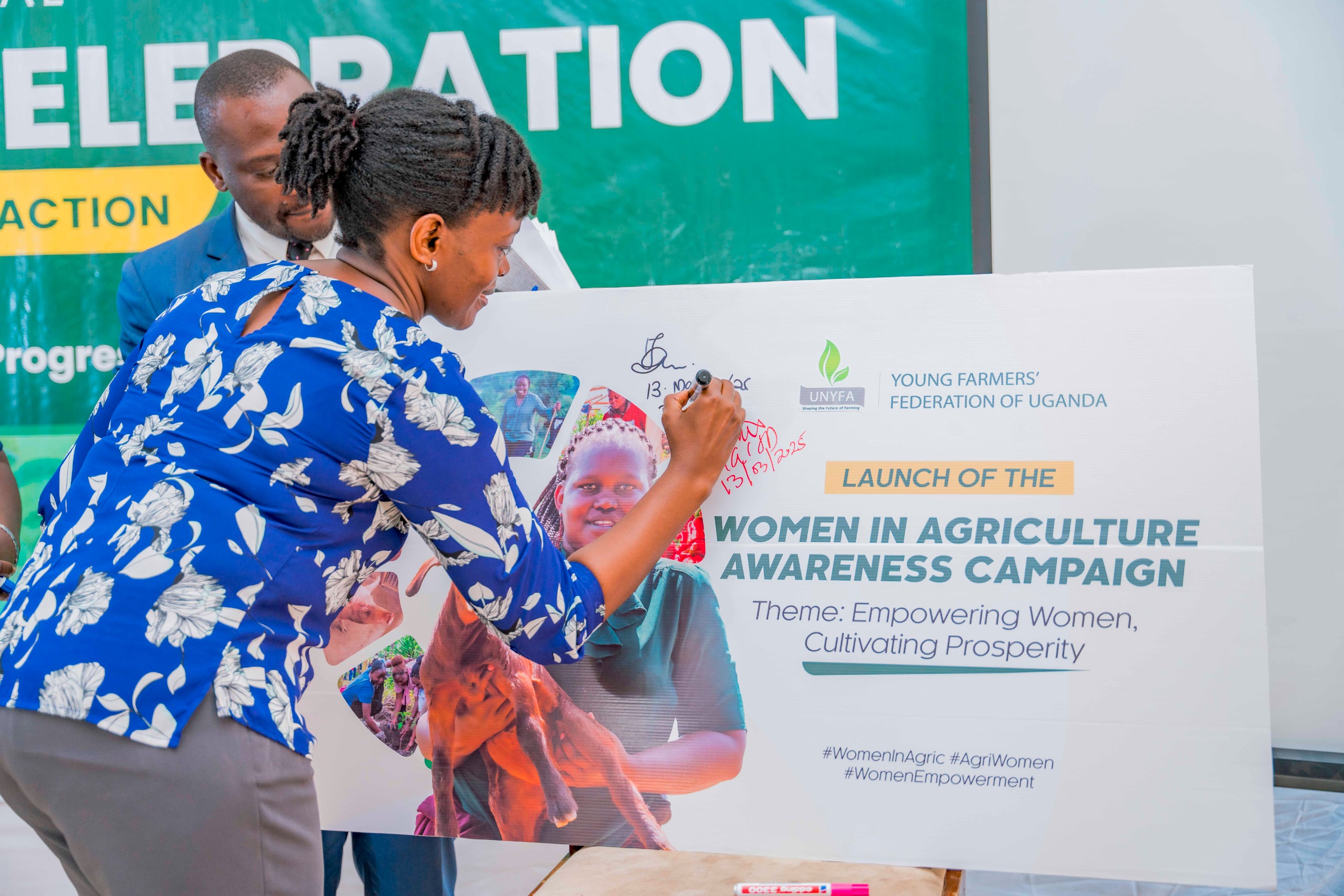

During the session, Julius Akais, Supervisor of Agriculture and Partnerships at PostBank Uganda, led a focused presentation to 15 rural women farmer group leaders from across Uganda, alongside delegates from Kenya and Zambia. The participants were introduced to PostBank’s comprehensive suite of financial products tailored for informal and group-based farming systems, with a strong emphasis on women-led agricultural enterprises.

“Our participation in this exhibition not only reinforces our commitment to advancing financial inclusion, but also creates valuable opportunities for deeper collaboration with sector stakeholders such as agro-input suppliers, irrigation solution providers, mechanization experts, and regulatory bodies,” Akias said.

He also highlighted the bank’s ESG-aligned loan assessments under the Agriculture Credit Facility (ACF) and shared insights into various partner-supported financing programs designed to enhance resilience and productivity in the agricultural sector.

Akais emphasized the bank’s continued commitment to advancing Uganda’s agricultural transformation, noting that PostBank remains focused on empowering rural communities, women-led farming groups, and informal cooperatives through tailored financial solutions and strategic partnerships that drive sustainable growth.

It should be noted that earlier in June, PostBank was recognized by the Bank of Uganda at the Agriculture Credit Facility (ACF) and Small Business Recovery Fund (SBRF) Awards, taking home five awards and 11 certificates. These accolades highlighted the bank’s ongoing leadership in inclusive agricultural finance, product innovation, and responsible lending.

“PostBank’s purpose is to foster prosperity for Ugandans. We do this by ensuring that our products address the real financial needs of our customers—especially in agriculture, which employs nearly 60% of Uganda’s workforce. We are bridging the gap between finance and food security,” Akais emphasized.

He noted that while the agricultural sector continues to evolve amid climate change, market pressures, and technological innovation, PostBank’s active role in platforms like the National Agricultural Show signals its unwavering focus on making finance work for farmers—not just in Uganda, but across the region.

Leave a Reply