Dr. Alhaj Kaddunabbi Ibrahim Lubega, CEO of IRA Uganda, with Hon. Henry Musasizi, State Minister for Finance, Planning, and Economic Development during the Conference

Insurance regulators and experts are challenging industry players to rethink strategies, embrace innovation, and prioritize customer experience as the sector seeks sustainable growth in evolving financial landscapes.

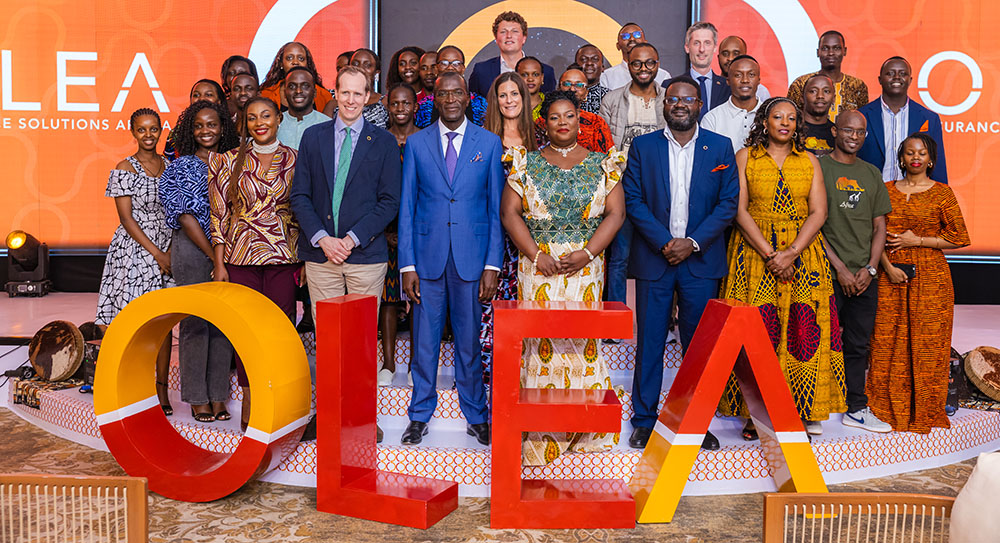

The call was made during the 47th Organization of Eastern and Southern Africa Insurers (OESAI) Annual Conference and AGM held on 25 August at the Speke Resort Convention Centre, Munyonyo.

Delivering a keynote address on “The Role of the Regulator in the Insurance Industry Customer Experience Agenda”, Dr. Alhaj Kaddunabbi Ibrahim Lubega, Chief Executive Officer of the Insurance Regulatory Authority of Uganda (IRA), emphasized that the regulator’s role is no longer confined to solvency oversight and compliance enforcement.

According to Dr. Kaddunabbi, regulators today are becoming active enablers of customer experience—ensuring that insurance markets remain not only stable but also transparent, fair, inclusive, and innovative.

“The regulator is no longer just a compliance enforcer but a business enabler—balancing customer protection with market development, and fostering innovation while amplifying the voice of policyholders,” he noted.

Dr. Alhaj Kaddunabbi Ibrahim Lubega, Chief Executive Officer of the Insurance Regulatory Authority of Uganda

Dr. Alhaj Kaddunabbi Ibrahim Lubega, Chief Executive Officer of the Insurance Regulatory Authority of Uganda

He explained that as insurance becomes more digital and customer-driven, regulators must strike a careful balance between protecting policyholders and enabling market development. Uganda, he said, is already taking steps in this direction with initiatives such as the Insurance Consumer Protection Guidelines and the forthcoming Insurance Complaints Bureau Regulations, both aimed at strengthening fairness and accountability in the industry.

Dr. Kaddunabbi also situated Uganda’s regulatory reforms within a global context.

He drew lessons from the United Kingdom’s Consumer Duty rules that require firms to deliver positive outcomes for customers, South Africa’s Treating Customers Fairly (TCF) framework, and Kenya’s inclusive insurance agenda driven by technological adoption.

These examples, he argued, reflect an evolving international consensus that regulators must embrace customer-centric supervision.

The 47th OESAI Conference attracted leading players from across the continent, with Uganda Reinsurance Company (Uganda Re) participating as a Gold Sponsor.

The company’s Chairperson, Dr. Joyce Namirimo Tamale, led the Ugandan delegation alongside CEO and Local Organizing Committee Chairperson Ronald Musoke, Chief Technical Officer Andrew Kawuzi, Chief Finance Officer Racheal Naggayi.

In his opening remarks, Uganda Re CEO Ronald Musoke welcomed delegates and applauded Uganda’s hospitality.

He described the event as a vital platform for collaboration and knowledge exchange, thanking the government, regulators, partners, and the organizing committee for their support.

One of the most engaging sessions was a panel discussion moderated by Uganda Insurers Association (UIA) CEO, Jonan Kisakye, under the theme “The New Customer – The Who, The Why, The How and The How Not.” Kisakye highlighted that Africa’s unique market dynamics, noting that the continent is mobile-first with 65% smartphone usage, over 500 million mobile money accounts, and a rapidly expanding middle class of 350 million people.

“Africa’s insurance market is bursting with opportunity, but the real challenge is closing the gap between what customers expect and what insurers deliver. If we cannot provide speed, affordability, and personalized products, we risk losing relevance in a market that is mobile-first and customer-driven,” he noted

Yet, despite these opportunities, he pointed out a striking gap: while 70% of customers expect personalized products, only 5% of insurers currently deliver them.

He stressed that the future of the industry hinges on responding to customer expectations for speed, affordability, personalization, and choice.

Panelists echoed these concerns. Patience Mashaire Marwiro, Managing Director of Emeritus International, observed that strategies must evolve to reflect generational differences. She explained that Generation X values loyalty, Millennials are digital-first, Gen Z prioritizes speed and social media engagement, while Gen Alpha is expected to be entirely AI-driven.

Some of Panelists during the conference

Some of Panelists during the conference

Joseph Nsubuga, CEO of Mirai General Insurance Uganda, emphasized the importance of rebuilding trust by listening to customers, tailoring products to their needs, and embedding a strong feedback culture.

Similarly, Mugove Nyimo, Regional Executive for Southern Africa at Sanlam Allianz, reinforced the urgency of personalization.

He urged insurers to leverage mobile technology to meet customer expectations while maintaining affordability and accessibility.

Adding another perspective, Dr. Dorothy Kyeyune, CEO of Mwoyo Experience, highlighted the growing influence of digital platforms. She noted that today’s empowered customers can shape reputations instantly through online reviews and social media, making customer experience a decisive factor in competitiveness.

The conference also featured a cultural welcome dinner, hosted by the Uganda Insurers Association (UIA).

Delivering remarks on behalf of the association, UIA Board Chairperson Ruth Namuli said the evening’s theme—“A Night of Unity in Diversity”—was more than just a celebration; it reflected the spirit of OESAI’s mission to strengthen Africa’s insurance industry through collaboration, innovation, and mutual learning.

She expressed Uganda’s pride in hosting this year’s edition of the conference, noting that the country was not only showcasing its insurance expertise but also its rich cultural heritage. From music and dance to cuisine, delegates experienced Uganda’s diversity, which Namuli described as a symbol of Africa’s resilience and opportunity.

Leave a Reply