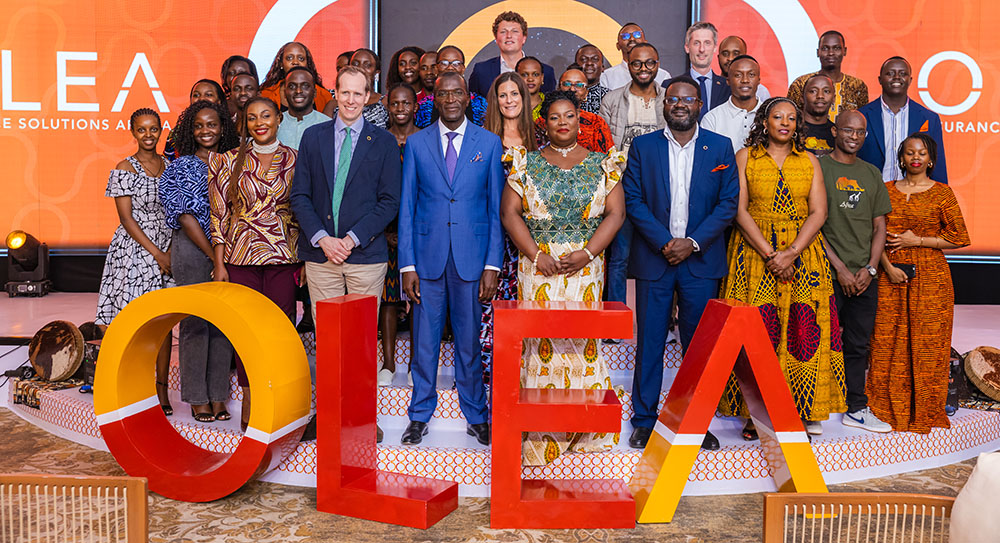

ICEA LION Asset Management Team, and trsutees and custodians from KCB Bank and Stanbic Bank

ICEA LION Asset Management (ILAM) reported strong performance across its Unit Trust Funds during its Annual General Meeting (AGM) on 12th September, 2025 at Protea Hotel for the financial year ended December 2024. The meeting reflected the company’s continued growth in assets under management, membership, and fund performance, further cementing its position as one of Uganda’s leading investment managers.

In 2024, ILAM recorded robust results across its portfolios. Membership grew by 40% to close the year at 9,000, and has since risen beyond 12,000. Total fund revenue increased by 39% to UGX 50 billion, up from UGX 36 billion in the previous year. Similarly, the total fund value rose by 38% to UGX 468 billion, and currently stands well above UGX 620 billion.

Speaking at the AGM, Owen Kato, the General Manager of ICEA LION Asset Management, said the growth trajectory demonstrated the trust that clients continue to place in the company. “We are proud to report that our business continues to grow strongly, with total assets under management now in excess of UGX 1 trillion and membership surpassing 12,000. This reflects the confidence our clients place in us as their trusted investment partner.”

The Money Market Fund (MMF) remained the company’s flagship fund, delivering exceptional results. “Our Money Market Fund delivered exceptional results. Profits grew by 47% to UGX 43 billion, compared to UGX 29 billion in 2023. Members’ balances increased to UGX 458 billion from UGX 321 billion, while revenues rose by 48% to UGX 48 billion. Importantly, the fund’s yields ranged between a low of 10.77% and 12.44% as the highest recorded in 2024, and are now north of 12.7%, making this a highly attractive investment vehicle,” Kato explained.

Other funds continued to serve investors seeking different options. The Income Fund recorded a profit of UGX 1.3 billion and Balanced Fund, which combines equities and fixed-income investments, posted a profit of UGX 66 million, continuing to provide a valuable diversified choice for investors.

Kato emphasized, “Overall, our funds registered strong growth in 2024, driven primarily by the Money Market Fund. These results reflect our commitment to delivering value, stability, and consistent returns to our investors.”

The Fund Management Report, presented by Senior Portfolio Manager Cindy Kukunda, highlighted the macroeconomic environment that supported this performance. She noted that the Uganda shilling remained the best performing currency in East Africa over the past five years, appreciating by 2.9% in 2024 compared to a 1.8% depreciation in 2023, largely due to strong exports and foreign investor inflows. “While there are risks that could drive inflation upward, we expect it to remain below the 5% medium term target. Looking ahead, we expect the shilling to remain stable, supported by oil exploration, strong coffee exports, and gold inflows. Inflation is likely to stay within the 4% – 4.5% range, while GDP growth is projected at 7%, boosted by expected crude oil production in 2026,” she said.

The AGM underscored ICEA LION’s continued investment in technology aimed at transforming the customer experience. Emmanuel Mwaka, Executive Director of ICEA LION Asset Management, reaffirmed this commitment, stating:

“We are introducing innovative solutions that give you greater control and visibility over your funds. Our upcoming self-service portal and mobile app will make it easier than ever to track your investments and engage with us seamlessly. Through the collective investment schemes we manage, we have consistently demonstrated the value we deliver to our clients. With this momentum, we are confident of achieving our target of 25,000 accounts in the near future.

The AGM closed with optimism for the year ahead, with ILAM reaffirming its commitment to delivering consistent returns, embracing digitalisation to enhance accessibility, and maintaining resilience amid both global and domestic market dynamics.

Leave a Reply