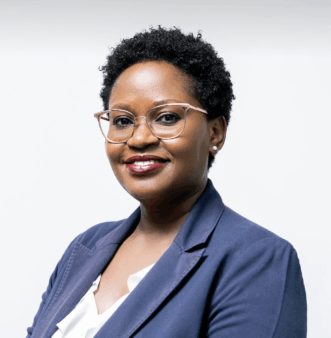

In December last year, OLEA completed the acquisition of Marsh Uganda, a transformative deal that has redefined Uganda’s insurance brokerage business. Finance & Trade spoke with Fiona Magezi, Managing Director, about the strategic and financial rationale for the acquisition, integration priorities, growth drivers, and long-term value creation. The discussion also highlighted how OLEA leverages scale, expertise, and innovation to strengthen client relationships, reinforce market leadership, and shape the broader insurance ecosystem.

This acquisition transforms OLEA’s market position overnight. Looking beyond the headline, what was the core strategic and financial rationale for acquiring Marsh Uganda? What specific gaps did it fill that organic growth could not address in your desired timeframe?

The acquisition of Marsh Uganda was driven primarily by two considerations: time-to-market and accelerated capability development. Strategically, it allowed OLEA to rapidly scale operations and establish credible presence within Uganda’s elite corporate and multinational sector, effectively achieving in months what organic growth would have taken several years to accomplish.

From a financial perspective, Marsh Uganda brought steady, annuity-style revenue streams, strong client retention, and exposure to technically complex and high-value risks that complement OLEA’s strengths in construction, energy, aviation, and international programs. These elements also strengthened our portfolio diversity.

Most importantly, the acquisition provided deep institutional relationships with insurers and reinsurers, advanced risk advisory capabilities, and immediate access to large corporate and international markets. These were gaps that organic growth alone could not bridge within the required timeframe. Instead of slowly building credibility and market share, OLEA was able to instantly achieve brand parity with global brokers while continuing to operate under its Pan-African entrepreneurial model.

In short, this acquisition was about strategically leapfrogging into a market leadership position, combining scale, expertise, and credibility in a way that would have taken years to replicate organically.

Integrating a global player is a complex operational undertaking. What is your joint 100-day plan to capture the most critical synergies—be it in client portfolios, technology, or talent—and how will you measure the success of this integration phase?

Our 100-day integration plan is focused on three strategic pillars. These include clients, technology, and talent. The aim is to capture meaningful synergies quickly while ensuring seamless continuity for clients and operational stability across the organization.

We are meticulously mapping all client accounts, with particular attention to complex placements and international programs, to guarantee uninterrupted service. Dedicated account managers and cross-functional oversight teams have been deployed for strategic clients to preserve institutional knowledge, maintain service quality, and identify immediate opportunities for cross-selling and value enhancement. This ensures that no client experiences disruption during the integration process, while also accelerating OLEA’s ability to serve a broader range of high-value, technically complex accounts.

On the digital front, Marsh Uganda’s systems and data have been harmonized into OLEA’s digital ecosystem. This consolidation enhances operational efficiency, creates a single source of truth for client data, and enables real-time reporting and transparency for both clients and internal stakeholders. Beyond continuity, this integration lays the foundation for advanced analytics, improved risk insights, and streamlined processes that strengthen service delivery and decision-making.

We track a range of metrics to evaluate the effectiveness of the integration over the first six to twelve months. These metrics include client retention rates, particularly among strategic and high-complexity accounts; cross-sell penetration, which measures the adoption of OLEA’s broader services across Marsh Uganda’s client base; employee attrition, ensuring the retention of critical talent and institutional knowledge; and operational and financial performance, including improvements in margins and overall efficiency.

By carefully monitoring these indicators, we can ensure that the integration is not only seamless but also accelerates value creation, strengthens client relationships, and positions OLEA to capture the full strategic and financial benefits of the acquisition.

The brokerage landscape is now fundamentally reshaped. How does the combined entity intend to compete differently? Will you compete on breadth of services, specialized expertise, pricing, or a combination of both?

The brokerage landscape has certainly shifted, and for us, competition is not about being the lowest-cost provider, but delivering unmatched value. The integration of Marsh Uganda with OLEA gives us a distinctive advantage. We can now offer the breadth and capabilities of a global broker while retaining the agility, accessibility, and responsiveness of a local partner.

Clients today are looking for more than just transactional insurance. Clients want strategic risk advice, innovative solutions, and proactive service. With this combination, we are uniquely positioned to deliver on these expectations across complex areas such as employee benefits, reinsurance structuring, international placements, and technically sophisticated industry programs. At the same time, decision-making remains close to the client, ensuring speed, relevance, and personalization.

What truly differentiates us is the blend of global expertise and local insight, supported by a deep understanding of client businesses and industry dynamics. We intend to compete by providing solutions that are tailored, scalable, and forward-looking, thus helping our clients not only manage risk but also seize opportunities as they grow. In essence, our strategy is a combination of specialized expertise, service excellence, and comprehensive offerings, all delivered with the personal touch that comes from being rooted in the local market.

With this new scale, where are the primary growth engines? Do you plan to deepen penetration in existing corporate sectors, expand into new customer segments like SMEs or retail, or leverage this as a platform for further regional expansion?

Our growth strategy is deliberate and focused on high-value, advisory-led segments where we can create meaningful differentiation. First, we see substantial opportunity in the upper-tier SME space. These businesses are evolving rapidly and increasingly require sophisticated risk solutions that go beyond standard insurance products. Leveraging OLEA’s corporate expertise, combined with our enhanced digital tools and scalable platforms, we can deliver solutions that are both accessible and cost-effective, meeting the complex needs of these growing enterprises.

While retail clients remain on our radar, this segment will be opportunistic rather than central to our strategy. Our focus is on markets where our advisory-led approach can truly add value—where tailored solutions, deep technical expertise, and proactive risk management distinguish us from competitors.

In addition, the integration positions us as a platform for further regional expansion, enabling us to replicate our model across neighboring markets while maintaining the agility and client proximity that define our local service advantage. In short, we are scaling with purpose, combining global standards, local insight, and targeted innovation to unlock growth where it matters most, for both clients and the business.

An acquisition of this size requires disciplined capital allocation. What key financial metrics will you, as MD, now be watching most closely to ensure this deal delivers value to shareholders, and what is your timeline for expected ROI?

From a governance and oversight perspective, we are closely monitoring a combination of quantitative and qualitative metrics to ensure the acquisition generates sustainable value. On the financial side, we focus on organic revenue growth, cost-to-income ratios, margin improvement, and return on invested capital (ROIC). These metrics provide insight into operational efficiency, profitability, and the financial leverage of the integration.

Equally important are qualitative indicators that drive long-term value creation. These include cross-border revenue contribution, the successful integration and retention of key talent, and the realization of synergies across client portfolios, technology platforms, and advisory capabilities. Together, these metrics give a holistic view of both performance and the strategic positioning of the combined entity.

We expect to see meaningful returns within three to five years, driven by a combination of cost efficiencies, optimized use of technology, and revenue growth from the expanded service offering. This includes leveraging OLEA’s full suite of solutions—reinsurance structuring, employee benefits, and strategic advisory services—to deepen client relationships, cross-sell effectively, and capture higher-value opportunities across both corporate and multinational accounts.

In short, disciplined financial oversight, coupled with strategic execution, ensures the acquisition not only delivers short-term operational gains but also long-term shareholder value.

Rapid scale brings operational and cultural risks. What do you see as the single biggest risk to realizing the full strategic value of this merger, and what specific mitigation plans do you have in place?

From a governance perspective, our leadership is closely monitoring key financial and operational indicators, including organic revenue growth, cost-to-income ratios, client retention, and return on invested capital. Equally important are qualitative metrics such as cross-border revenue contribution and talent retention, which help safeguard the organization’s culture and long-term capabilities.

We anticipate realizing the full strategic benefits within three to five years. This will be driven by a combination of cost efficiencies, optimized technology utilization, and increased revenue from leveraging OLEA’s diverse offerings, including reinsurance, employee benefits, and advisory solutions. Our mitigation approach focuses on disciplined oversight, proactive talent management, and strategic alignment across all business units.

Looking 3-5 years ahead, what does ‘winning’ look like for OLEA? Beyond market share, how do you intend to use this enhanced position to influence product innovation, industry standards, or the overall insurance culture in Uganda?

Over the next three to five years, success for OLEA will go beyond market share. Winning means establishing OLEA Uganda as a thought leader in risk management and shaping how businesses, investors, and policymakers understand and leverage insurance.

We aim to raise the bar in claims processing, transparency, and digital service delivery, while driving product innovation in areas such as cyber risk, political violence, infrastructure, and employee benefits. Ultimately, success will be measured by OLEA’s ability to professionalize Uganda’s risk culture, strengthen resilience, and support sustainable economic growth.

With OLEA now operating at a significantly larger scale, how do you intend to engage with regulators and policymakers? Do you see this increased market presence as bringing a greater responsibility—or opportunity—to shape the regulatory and policy environment for the broader insurance sector in Uganda?

Growth brings with it sizeable responsibility and unique opportunity. As OLEA expands, our goal is to serve as a trusted partner to regulators, policymakers, and industry stakeholders by offering deep technical expertise across areas such as regulatory compliance, solvency standards, mandatory insurance frameworks, and emerging risk management. We engage proactively with authorities not to seek regulatory loopholes, but to help build a stronger, more transparent, and sustainable insurance ecosystem that benefits all participants.

With our expanded presence in Uganda, OLEA is strategically positioned to contribute meaningfully to policy discussions, advocating for frameworks that encourage investment, foster innovation, and enhance consumer protection. We aim to share best practices, support capacity building, and provide insights that help the sector respond effectively to evolving market and technological challenges. By promoting sound regulation and industry standards, OLEA not only strengthens its own operations but also helps drive broader sector growth, increased public trust, and long-term resilience for the Ugandan insurance market.

Leave a Reply