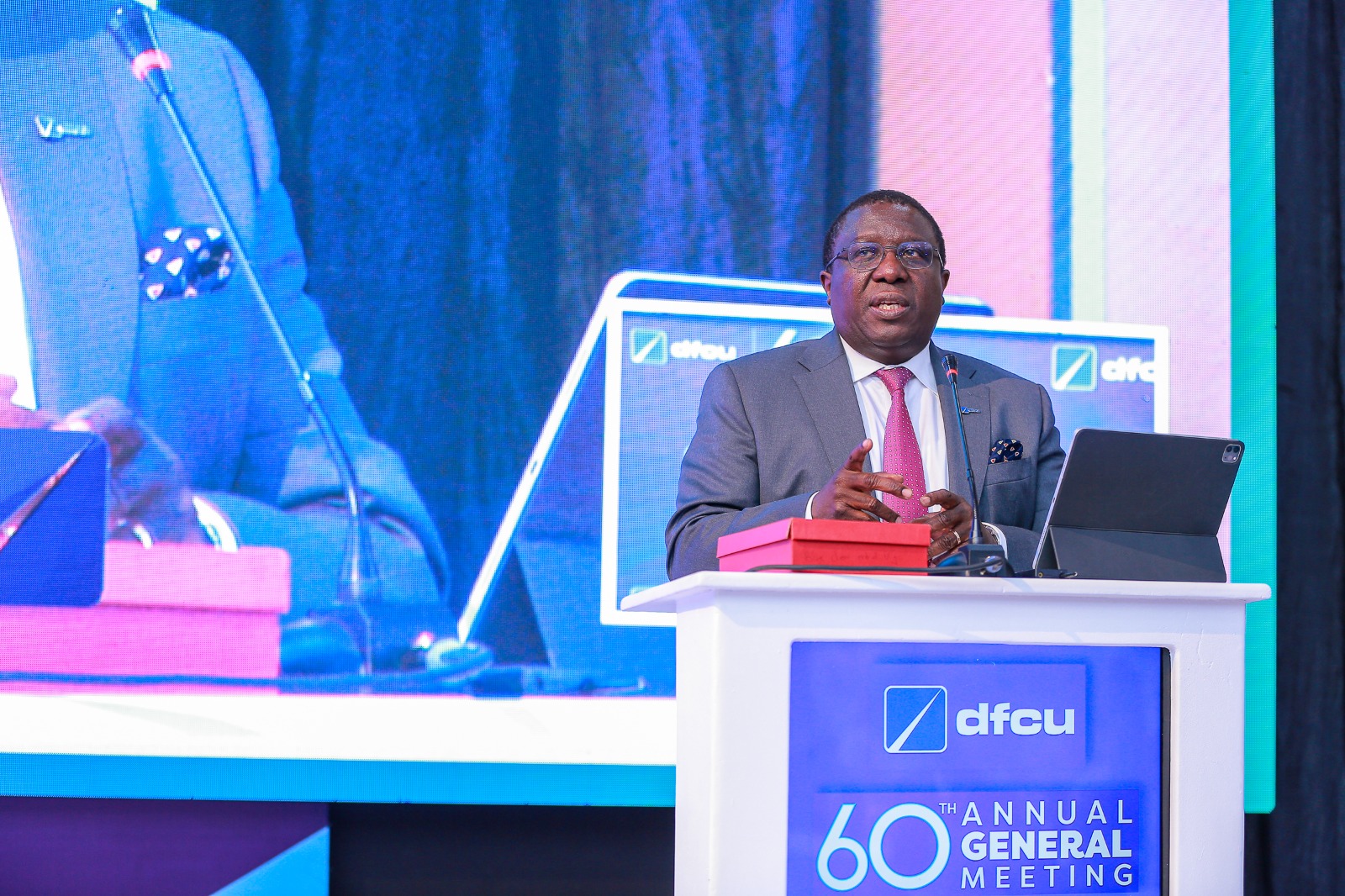

Jimmy D. Mugerwa, Board Chairman of dfcu, addressing shareholders during the Annual General Meeting (AGM) at Hotel Africana in Kampala

DFCU Limited has posted remarkable financial results for the year ended December 2024, reaffirming its reputation as one of Uganda’s top-tier financial institutions.

During the 60th Annual General Meeting (AGM) held at Hotel Africana in Kampala on July 11, Board Chairman Jimmy D. Mugerwa described the year’s performance as “stellar,” pointing to significant growth in profitability, customer confidence, and shareholder returns.

The meeting drew participation from shareholders, executives, and industry observers, all eager to hear how the bank had not only recovered from previous setbacks but had also laid a strong foundation for future growth. The meeting provided an in-depth review of the bank’s financial achievements and its forward-looking strategy to remain competitive in a rapidly evolving banking landscape.

Mugerwa underscored that the bank’s net profit had climbed to sh72b, reflecting a solid turnaround. In response to the improved performance, the board declared a dividend payout of sh20 per share, significantly higher than the previous year’s distribution—a move that delighted investors and signaled confidence in the bank’s long-term trajectory.

“In 2024, we grew our profits, expanded our asset base, reduced our debt, and declared a higher dividend. This is a testament to the strength of our strategy and our team’s execution,” Mugerwa told shareholders.

He explained that this transformation was not accidental but the result of disciplined execution, sharper customer focus, and strategic realignment. DFCU’s management had taken deliberate steps to improve operational efficiency, reduce bad debts, and invest in digital infrastructure.

Despite a volatile global economic environment marked by inflationary pressures, currency fluctuations, and geopolitical instability, DFCU stayed the course by remaining agile and grounded in fundamentals. Mugerwa noted that a forward-looking and customer-centric culture had become central to DFCU’s strategy.

“We realigned our operations to meet the needs of the modern banking customer while maintaining cost discipline and strong corporate governance,” he said.

He also emphasized the importance of the bank’s history and values. Celebrating its 60th anniversary in parallel with Uganda’s own diamond jubilee of independence, Mugerwa said the bank had grown alongside the country and remained committed to its development.

“DFCU is as old as Uganda’s independence. We’ve grown with this country, and our legacy of trust has helped us build a strong brand,” Mugerwa said.

dfcu’s Managing Director, Charles Mudiwa

dfcu’s Managing Director, Charles Mudiwa

Strategic Transformation, Financial Turnaround, and Future Readiness

DFCU’s Managing Director, Charles Mudiwa, provided shareholders with a comprehensive overview of the bank’s multi-year transformation journey, which began in 2023. The initiative aims to reposition the bank to meet the demands of a modern financial sector while creating meaningful impact in critical areas of Uganda’s economy.

“We embarked on a three-year strategic journey to transform our bank—internally and externally. This transformation isn’t just about financial performance; it’s about being fit for the future,” Mudiwa said.

The strategy focuses on enhancing DFCU’s competitive position in corporate and investment banking, retail banking, women in business, savings and investment clubs, and digital banking. It also identifies eight priority sectors—agriculture, manufacturing, education, health, infrastructure, ICT, public services, and financial institutions—as growth engines where DFCU plans to expand its presence.

In 2024, the transformation entered its second phase, emphasizing leadership reorganization, technology upgrades, and cybersecurity. One key milestone was the appointment of Farid Abateke as Acting Chief of Cyber Information Security, a role created to enhance the bank’s digital resilience amid rising cyber threats.

“Cybersecurity is now central to how we operate. Trust and data integrity are non-negotiables,” Mudiwa said.

Technology modernization was another pillar of the year’s transformation. The bank rolled out robotic process automation (RPA) to streamline internal operations, reduced turnaround times for retail credit approval from three days to less than one, and upgraded its card management and ATM systems to improve reliability.

Plans are now underway to upgrade DFCU’s core banking system to introduce enhanced self-service features, enable real-time transactions, and improve digital payment experiences for both retail and business clients.

These innovations contributed to tangible performance improvements. Online banking transactions surged by 37%, while customer satisfaction—as measured by the Net Promoter Score (NPS)—increased by 20 points, highlighting growing customer trust.

“Our efforts are not just about modernizing for the sake of it. It’s about offering fast, secure, and accessible banking that meets the evolving needs of Ugandans,” Mudiwa noted.

On the financial front, DFCU registered a significant leap in profitability. Net profit rose 151% from the previous year, supported by a 9% growth in total assets, which stood at Sh3.4 trillion by the end of 2024. The bank also recorded a net write-back of sh12b, a marked improvement from sh83b in loan write-offs the previous year.

The bank’s non-performing loan ratio dropped from 9.5% to 4.4%, and its footprint grew to 77 intelligent ATMs and 54 branches across the country. DFCU now has the third-largest lending network among commercial banks in Uganda.

“In 2024 alone, we paid sh100b in taxes to the Uganda Revenue Authority. This is part of our commitment to national development,” Mudiwa added.

Chief Financial Officer Rebecca Birungi reinforced the picture of a strong financial rebound. Reviewing the past four years, she reported a steady improvement in all core ratios.

The Non-Performing Ratio fell from 16% in 2021 to 4.4% in 2024, while the credit loss ratio improved from 9.8% to -1.1%, indicating stronger asset quality and effective recovery strategies.

Return on Equity climbed from 2% to 10%, while Return on Assets improved from 0.3% to 2%. Profit after tax rose from sh9.3b in 2021 to sh72b in 2024—an eightfold increase. Earnings per share grew from sh12.45 to sh96.35, and dividend payouts nearly doubled between 2022 and 2024.

The bank’s liquidity ratio closed at 34.2%, while both core and total capital adequacy ratios remained well above regulatory thresholds at 29.1% and 29.8% respectively.

“We have built a strong, stable financial base from which we can pursue future growth opportunities,” Birungi said. “We’re now well-positioned to support our customers and our shareholders in a sustainable way.”

Transforming Lives and Communities

DFCU says it has continued to make a lasting impact through its community development programs under the DFCU Foundation. The foundation has become a cornerstone of the bank’s mission to foster economic transformation through education, financial literacy, and agribusiness.

In 2024, the foundation trained 27,000 smallholder farmers in entrepreneurship and agribusiness management in partnership with the Agribusiness Development Centre (ADC), which has since become part of the DFCU Foundation. This initiative not only improved productivity but also enabled farmers to better access credit and manage risks.

Additionally, 402 enterprises benefited from the training and mentorship programs—54% of which were women-led, underscoring the bank’s commitment to gender inclusion.

DFCU also invested sh1.5b in social development projects across Uganda. Staff-led initiatives raised sh79.2m through the “60 Acts of Kindness” campaign, impacting over 10,000 individuals and organizations.

Women entrepreneurs received focused support through the Women in Business Growth Fund, with sh11.2b disbursed to 60 financial institutions operating in 30 districts. This support directly benefited 212 women and hundreds more indirectly.

The bank’s tailored financial services for savings and investment clubs reached 40,000 Ugandans directly and an estimated 100,000 indirectly, promoting grassroots savings and cooperative growth.

In the agriculture sector, DFCU reached over 9,000 farmers and 885 rural enterprises through development programs aimed at enhancing productivity, sustainability, and market access.

“We are not just a bank—we are a catalyst for socio-economic change. Our mission is to transform lives and build prosperity from the ground up,” Mudiwa said.

As the meeting concluded, the tone among shareholders and bank executives was one of optimism. The bank’s renewed strategy, financial strength, and social impact initiatives paint a picture of an institution ready for the future.

“Thank you for making it possible for us not only to deliver financial results but also to make a real impact—transforming lives and businesses across Uganda,” Mudiwa told shareholders.

DFCU’s 2024 performance is not only a story of numbers but also one of purpose, resilience, and transformation. With strong governance, advanced digital capabilities, and a commitment to inclusive growth, the bank is setting itself up to play an even bigger role in Uganda’s financial and socio-economic landscape.

Leave a Reply