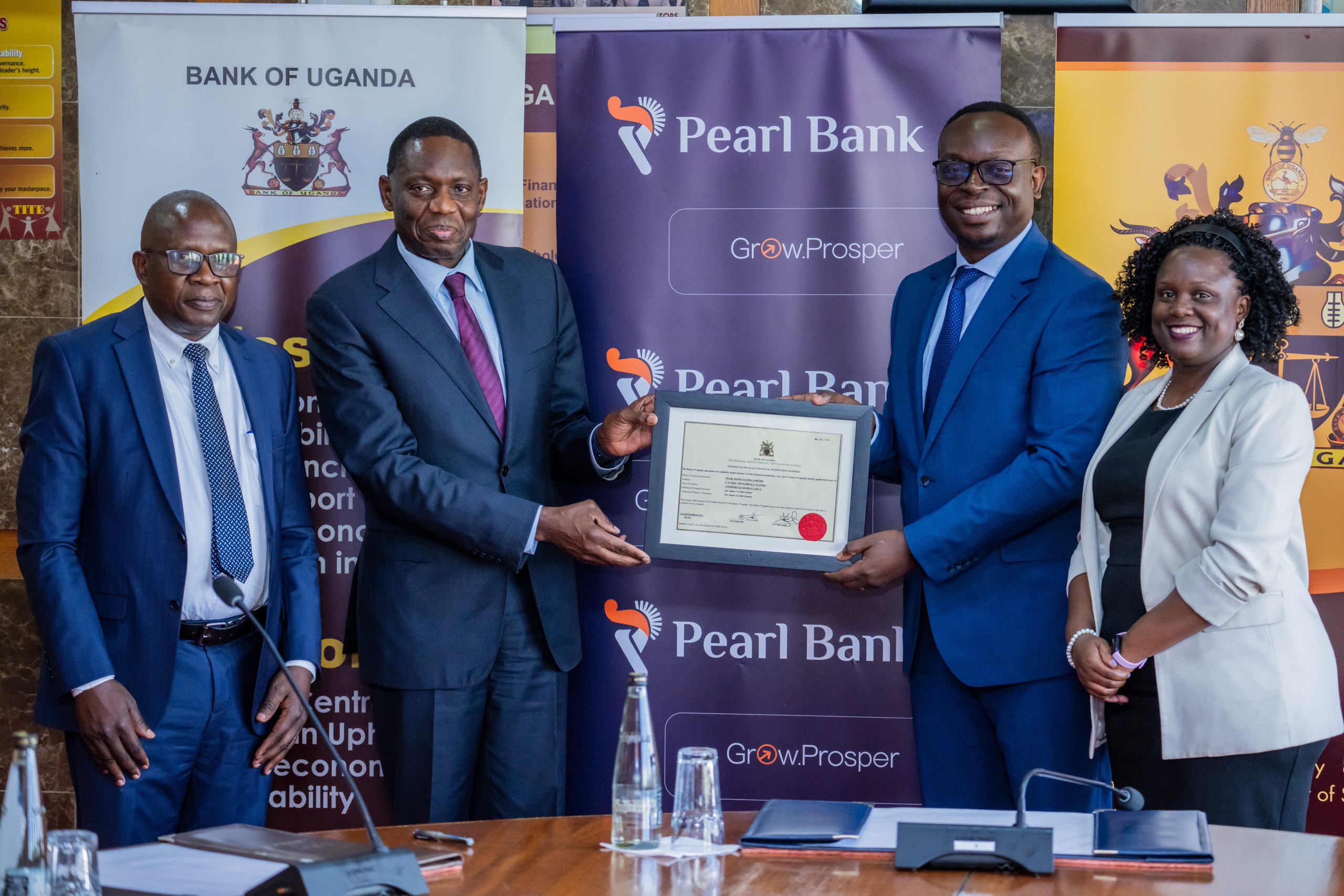

Finance Minister Matia Kasaija (yellow tie) and Investments Minister Evelyn Anite and Andrew otengo the board chairman of Post bank, during PostBank’s 2024 Annual General Meeting in Kampala PHOTO/COURTESY OF POSTBANK

Finance Minister Matia Kasaija has commended Postbank Uganda for its impressive financial performance and bold decision to rebrand, describing both as pivotal steps in strengthening the country’s banking sector and promoting inclusive economic growth.

Speaking at Postbank’s 2024 Annual General Meeting (AGM) held at the Ministry of Finance, Planning and Economic Development headquarters in Kampala, Minister Kasaija applauded the government-owned bank for posting a robust Shs35.4 billion profit after tax, marking a significant 28% growth compared to the previous year.

“The bank’s growth is a clear testament to its operational excellence and unwavering commitment to advancing financial inclusion for all Ugandans. Postbank continues to play a critical role in supporting government programs such as the Parish Development Model through its digital payment platform, enhancing transparency and efficiency,” Kasaija said.

During the AGM, shareholders unanimously approved the bank’s rebranding to Pearl Bank Uganda Limited, a name inspired by Uganda’s moniker- the “Pearl of Africa, famously coined by Sir Winston Churchill.

Kasaija indicated that Pearl Bank Uganda will be better positioned to attract strategic partners, mobilize high-value deposits, and scale up its support for micro, small, and medium enterprises (MSMEs) and the agriculture value chain.

He said the rebranding aligns perfectly with the government’s broader Agro-Industrialization for Local Economic Development (Agri-LED) and Agricultural Transformation Agenda for Modernization and Sustainability (ATMS) strategies, both of which focus on value addition in agriculture and inclusive financial growth.

With a strong financial footing and renewed strategic vision, he said the Pearl Bank will deepen its impact as a leading indigenous commercial bank dedicated to fostering prosperity and economic empowerment across Uganda.

Managing Director Julius Kakeeto said the rebranding represents a pivotal milestone in Postbank’s comprehensive five-year transformation journey. Over the past few years, Kakeeto said the Bank has intentionally focused on strengthening governance frameworks, investing in advanced technology, enhancing customer service, and achieving sustainable profitability. With these critical foundations firmly established, Postbank is now well-positioned to deepen its impact by delivering tangible economic and social value to Ugandans.

“The new identity as Pearl Bank Uganda will act as a powerful catalyst to attract strategic investors and high-value depositors who align with our long-term vision for inclusive and sustainable growth. This strengthened capacity will enable us to broaden our support for micro, small, and medium enterprises (MSMEs) and the agricultural sector, driving significant improvements in livelihoods, productivity, and overall economic resilience across the nation,” Kakeeto explained.

He said the bank reported a Shs35.4 billion Profit after Tax for the 2024 financial year, a 28% increase over the previous year, guided by its commitment to financial inclusion, customer-centric innovation, and operational excellence.

The bank also pegged its performance on expanding access to affordable financial services, particularly for underserved communities, which has continued to pay off.

In the 2024 financial year, the bank’s total income grew by 20% from Shs206 billion to Shs248 billion, driven by strong performance in both interest and non-interest income streams. Customer deposits surged by 25%, rising from Shs790 billion to Shs990 billion, reflecting increased public confidence and effective deposit mobilization strategies.

The bank’s loan book expanded by 19% to Shs 719 billion, signaling robust credit uptake across key sectors such as micro, small, and medium enterprises (MSMEs), agriculture, and public sector programs.

Board Chairman Andrew Otengo Owiny praised the Bank’s impressive performance, attributing the success to Postbank’s deliberate and well-executed transformation journey since it attained full commercial bank status in December 2021.

“I am delighted by the progress Postbank has made in becoming a transformative force in Uganda’s financial sector. In just a few years, the Bank has repositioned itself as a credible, inclusive, and resilient financial institution. With 57 physical branches and a growing network of over 6,000 agents spread across the country, we have significantly expanded our footprint, bringing essential banking services closer to the people and advancing the national agenda of financial inclusion,” Owiny stated.

He emphasized that this nationwide reach has enabled the Bank to serve marginalized and previously unbanked communities, support small businesses, and partner with government on strategic programs such as the Parish Development Model, further cementing Postbank’s role in inclusive economic development.

Owiny also highlighted the Bank’s instrumental role in advancing government-led initiatives, particularly the Parish Development Model (PDM), which aims to boost grassroots economic transformation. He noted that Postbank, through its proprietary digital platform Wendi, has streamlined the disbursement of funds by enabling direct, secure, and transparent digital payments to the final beneficiaries.

“This innovation has not only improved the speed and accuracy of service delivery but has also enhanced accountability and minimized leakages. It is a clear demonstration of how technology can be leveraged to deliver public value and drive inclusive growth,” Owiny said.

Leave a Reply