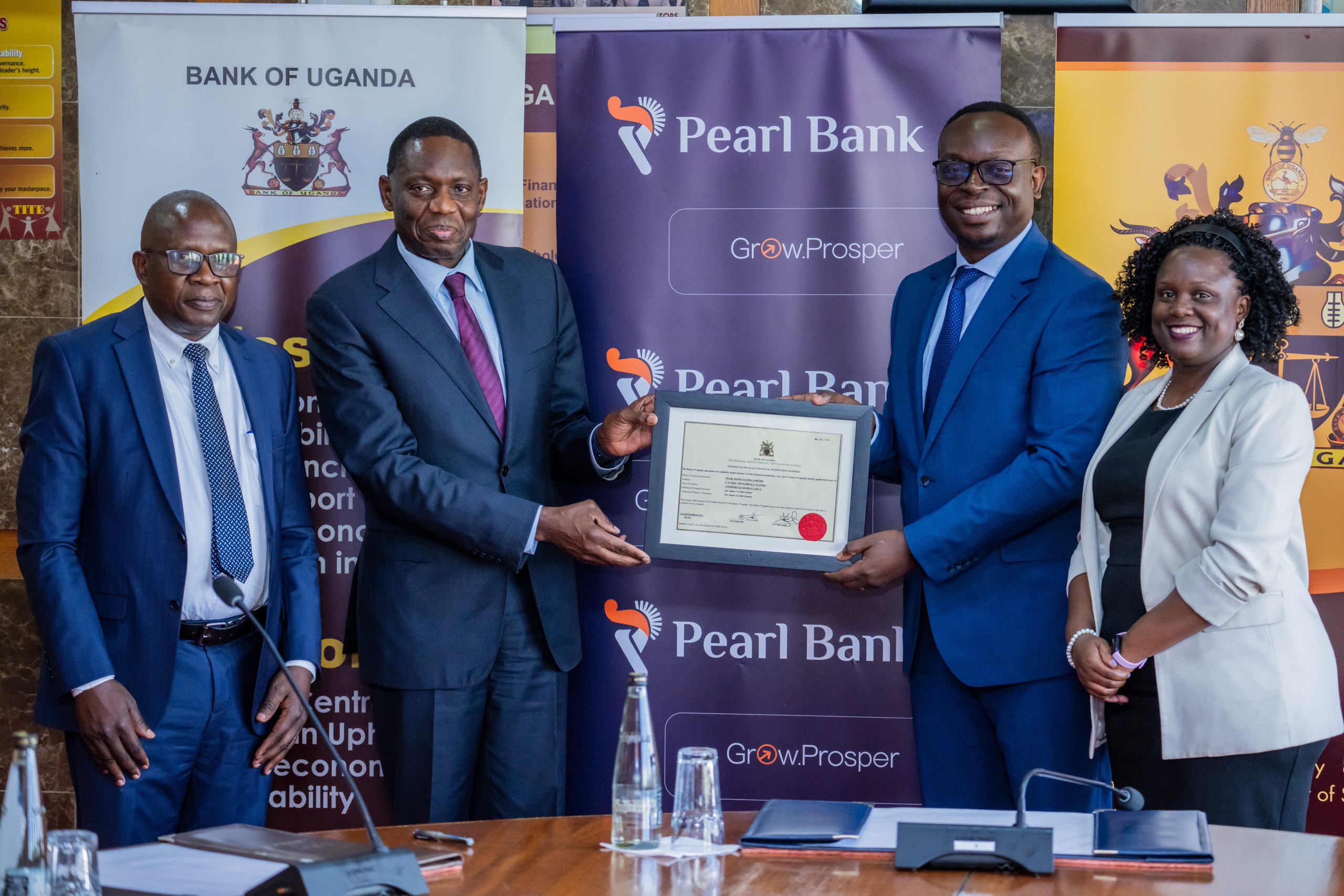

A group photo of officials from Housing Finance Bank and Easy Housing

In a landmark partnership set to transform homeownership in Uganda, Housing Finance Bank has joined forces with Easy Housing to provide sustainable, affordable housing solutions tailored to the needs of everyday Ugandans.

This strategic collaboration goes beyond traditional shelter, offering homes that are financially inclusive, environmentally friendly, and resilient to climate change. Through Housing Finance Bank’s long-standing commitment to enabling homeownership with Easy Housing’s innovation in circular, climate-smart construction, the initiative aims to deliver homes that adapt with families and harmonize with the environment.

Together, the two organizations are redefining the future of housing in Uganda making sustainable living accessible, inclusive, and enduring.

“Too often, affordability has meant compromise on quality, durability, or safety. This partnership challenges that mindset,” said Christopher Akugizibwe, Manager of Home Loans at Housing Finance Bank. “We are financing homes that are not only attainable but resilient homes that protect families, respect nature, and support Uganda’s vision for sustainable urban development.”

“We build with purpose for people and for the planet,” said Wolf Bierens, Managing Director of Easy Housing. “By joining forces with Housing Finance Bank, we are enabling more Ugandans to access homes that reflect dignity, safety, and sustainability. It is not just about affordability; it is about long-term value for families and the environment.”

The partnership was officially launched at the Housing Finance Bank Head Office in Kololo, marking a significant milestone in advancing sustainable and inclusive housing in Uganda.

The partnership supports Housing Finance Bank’s broader goals of inclusive growth, financial empowerment, and environmental stewardship. It directly addresses Uganda’s urgent housing deficit of 2.4 million with practical, scalable solutions that can be replicated nationwide.

Easy Housing’s model emphasizes modular construction using sustainable timber and locally sourced materials reducing carbon emissions while keeping homes cost-effective. The designs allow families to build incrementally based on their resources, without sacrificing structural integrity or comfort.

Customers can access these climate-resilient homes through Housing Finance Bank’s Home Loans, which offer repayment periods of up to 10 years, competitive interest rates, up to 80% financing, and a processing period of just 48 hours making homeownership easier and faster for Ugandans.

To get started, visit any Housing Finance Bank branch across Uganda, call the Contact Center on 0800211082, or visit www.housingfinance.co.ug.

Together, the two institutions are setting a new standard were owning a home means investing in a better future, not just for individuals, but for the nation.

Leave a Reply