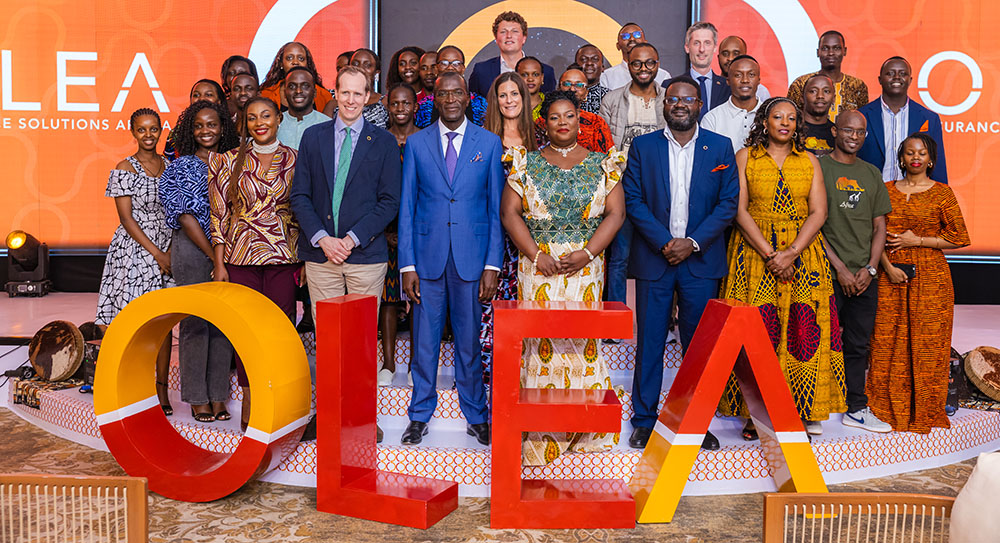

L-R-Laban-Mutebi-Manager-Personal-Insurance-Melisa-Nyakwera-Head-Commercial-Banking-Israel-Arinaitwe-Head-Personal-Banking-and-Sam-Bulenzi-Head-Coverage-during-the-launch-in-Kampala

Stanbic Bank Uganda has launched the ‘Oli In Charge’ campaign, a nationwide initiative aimed at providing affordable financing solutions to both salaried and self-employed Ugandans, empowering them to achieve their personal and business financial goals.

The campaign is designed to broaden access to financial resources for individuals and enterprises across the country, reinforcing the bank’s commitment to inclusive economic growth.

Speaking at the launch, Israel Arinaitwe, Head of Personal Banking at Stanbic Bank, said the campaign seeks to support customers with essential financial needs such as paying school fees, expanding businesses, and financing side hustles. He noted that the initiative aligns with the bank’s core purpose: “Uganda is our home, drive her growth.”

“Whether you are a young professional, a woman running a small business, a farmer scaling production, or a family planning for generational wealth, this campaign is for you,” Arinaitwe said. “We believe every Ugandan has the potential to grow, and we are committed to walking that journey with you.”

Affordable Financing for All

As part of the back-to-school season, Stanbic Bank is offering salaried customers unsecured personal loans of up to Shs 350 million, with flexible repayment periods of up to 120 months.

These loans can be accessed in under two minutes through the bank’s digital platforms, including the Stanbic App and *290# USSD, at discounted interest rates of 17 percent. Customers can also access interest-free cash advances of up to Shs 5 million.

Self-employed customers, particularly farmers, are also beneficiaries of the campaign. They can access unsecured loans of up to Shs 250 million at competitive interest rates starting from as low as 10 percent per annum.

“The focus on farmers demonstrates our commitment to supporting Uganda’s economic backbone and promoting financial inclusion in key sectors such as coffee, cocoa, palm oil, and sugarcane,” Arinaitwe added.

Strengthening Businesses and Education Financing

Melisa Nyakwera, Head of Commercial Banking at Stanbic Bank, highlighted a strategic partnership with Fincom Technologies, the creators of SchoolPay. Through this collaboration, private educational institutions can access pre-approved financing of up to Shs 1 billion, aligned to their cash flows, directly through the SchoolPay platform without the need to visit a bank branch.

“This partnership modernizes education financing, especially during the back-to-school season,” Nyakwera said. “By leveraging technology, we are improving access to affordable financing while strengthening institutions that shape Uganda’s future.”

She further encouraged business owners across all sectors to take advantage of tailored solutions such as invoice and contract financing of up to USD 1.5 million.

Protecting Financial Goals

Laban Mutebi, Stanbic Bank’s Personal Insurance Manager, noted that the ‘Oli In Charge’ campaign goes beyond financing by offering protection solutions that help customers safeguard their progress.

Customers who take out home loans automatically receive Mortgage Life Protection, which covers the outstanding loan balance in the event of death, critical illness, or permanent disability.

In addition, customers who open an Investa Plus account stand a chance to receive an instant deposit of Shs 50,000 into their child’s education plan.

Mutebi also highlighted the Homeowners Comprehensive Insurance cover, which protects property against fire and allied risks, ensuring customers’ investments remain secure.

Empowering Uganda’s Future

Sam Bulenzi, Head of Coverage at Stanbic Bank, encouraged Ugandans to leverage the bank’s digital platforms for faster and more convenient access to financial services, noting that Stanbic has made significant investments in infrastructure and innovation.

“Our initiatives are designed to support not only individuals but also businesses, especially women, youth, and farmers who have historically faced barriers to accessing affordable financing,” Bulenzi said.

“Through this campaign, we are reinforcing the belief that growth should be protected, not just financed. By combining affordable loans with insurance solutions, we are helping Ugandans safeguard their growth, their families, and their futures.”

The ‘Oli In Charge’ campaign will run throughout the back-to-school season and beyond, offering Ugandans an opportunity to take control of their financial futures through accessible loans, long-term investments, and comprehensive protection solutions.

Leave a Reply